Scammers are constantly trying new tactics to steal information, identities and money. With tax season upon us, it is important that we are all aware of the latest tax scam. We are seeing more instances of texts and emails regarding a “tax rebate” or some other tax refund or benefit.

Here is what you need to know about these scams so that way you can safely avoid them. If you receive an unexpected message stop, think and do not click any links. Despite how harmless it may seem, clicking on a link can expose your personal information and make your device vulnerable to malware.

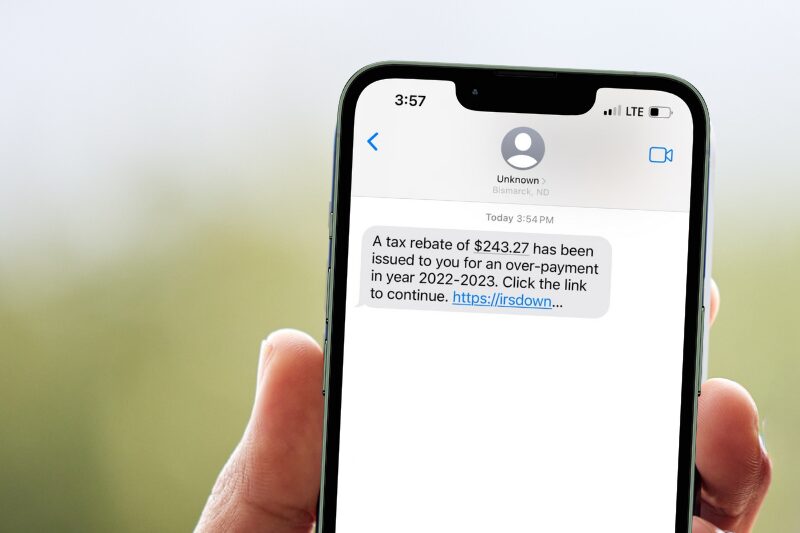

Here is an example of what a suspicious text might look like:

When dealing with unexpected messages like the one above, here are the top things to remember:

- The IRS will not call, email or text to contact you for the first time. They will always send you a letter first. If you are uncertain if it is the IRS messaging you, please call the IRS directly at 800-829-1040 to confirm.

- You can find the status of any pending refund on the IRS official website at: www4.irs.gov/wmr/.

- Do not click on any links and do not share any personal information.

- Do not respond to the message. By responding, you can open yourself up to more scamming attempts. Scammers will often take responses and classify them as active numbers or email addresses and will then compile lists to sell to other cyber criminals.

- Report these messages to the IRS. Forward a screenshot or the email as an attachment to phishing@irs.gov.

We all must have a healthy level of skepticism when dealing with information requests. These cyber criminals only need to be right once, we as consumers need to be right every time, so make sure you stop and think before you proceed. If you clicked a link in one of these messages and believe you may have shared personal information, please file a report at IdentityTheft.gov to get a customized recovery plan.